18 Jul Financing business in the Netherlands: Debt or Equity, from a tax perspective

The Netherlands, as one of the world’s largest recipient of foreign investment, has a very stable economy environment, with relatively low deficits and inflation rate. From a tax perspective, the Netherlands is open and attractive for financing activities due to the country’s tax authorities’ pragmatic approach, extensive tax treaty, and ruling practice. If you ever think about investing a Dutch company, this article is helpful for you. In this article, two ways of investing namely, debt capital and equity capital, are explained and compared.

Concepts: Debt capital vs Equity capital

Funding with debt capital or equity capital depends on whether the investor is (or willing to be) a shareholder or a lender. Debt capital is a form of investment provided as a loan. Generally speaking, a lender will provide debt capital and expect to receive the principle amount including interest at an agreed time. Meanwhile, equity capital is a form of investment that, in contrast to debt capital, is not repaid to the investors. The investor in this case is normally called a shareholder, as the owner of the legal entity. A shareholder provides equity capital as buying shares of the legal entity. These shares will provide the shareholder with “dividend”.

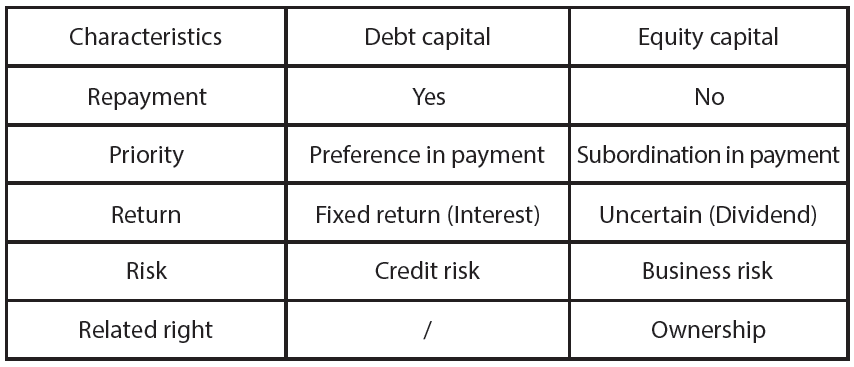

Characteristics: Debt capital vs Equity capital

The table below shows the general characteristics of debt capital and equity capital:

Tax-related aspects: Debt capital vs Equity capital

Debt capital: As mentioned above, when providing debt capital (lending a loan to the company), a fixed interest will be taken as the return to the debtor (lender). Such issuance of debt is in principle not subject to Dutch tax if it occurs under fair and reasonable terms and conditions. Meanwhile, interest on some business loan is tax deductible, for example, the interest of business credit card.

Equity capital: Investing by equity capital contributes to the equity of the legal entity. In principle, the contribution of equity is not regarded as a taxable activity, therefore, it does not have unfavorable Dutch corporate income tax consequences. In addition, there is no stamp duty levied by the Netherlands on equity contribution. However, dividends are not tax deductible when this amount is paid by the Dutch company.

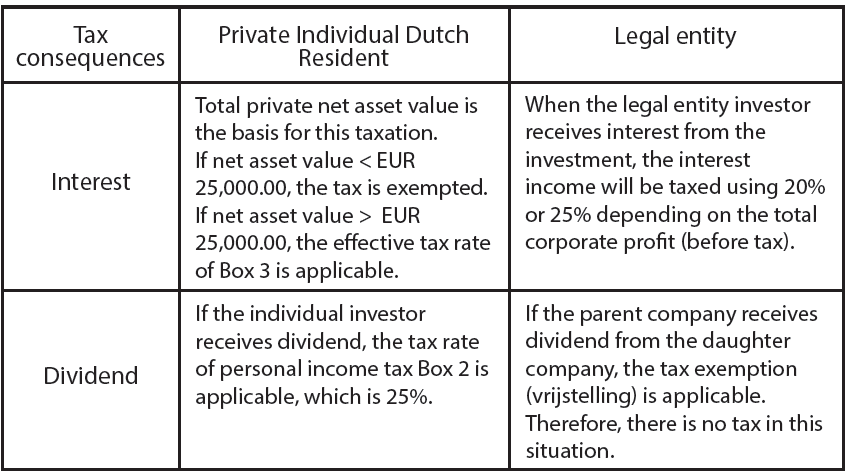

Tax consequences:

The table below explains the general tax consequences of interest and dividend from the investor’s perspective.

In a nutshell, there are advantages and disadvantages of each financing option. Making the investment decision depends on your personal preference and the situation.

Please contact us looking for more information on this subject and/or are in need of a (second) opinion.

No Comments