04 Jul Statutory Audit in the Netherlands

Often, directors as well as owners of a limited liability company (Besloten Vennootschap) or a public limited company (Naamloze Vennootschap) in the Netherlands, fail to recognize the company’s obligation to comply with Dutch statutory audit and consolidation requirements. As a consequence of such failure, the company will be charged with a penalty in the form of a fine and directors may face six months imprisonment.

Statutory audit (wettelijke controle) is a check of financial accountability of a company or institution for the purpose of social traffic, which is required by or under the Audit Firm Supervision Act (Wet toezicht accountantsorganisaties). The company has to prepare consolidated financial statements and/or have financial statements audited by a Dutch registered auditor (RA) or an accounting consultant (AA) who is authorised to certify financial statements.

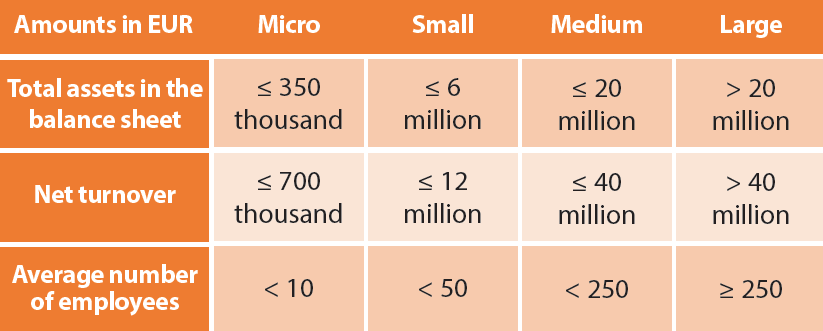

The extent to which a company in the Netherlands should comply with Dutch statutory audit is based on different sizes of the company; Companies are classified as micro, small, medium or large – this can be determined by reference to the following criteria in the table.

Out of the different company sizes, only medium and large companies are required to have their an-nual report audited by independent, qualified and registered Dutch auditors. In order to be categorized under a given company size; at least, two of the three criteria must be met in two consecutive financial years.

It is important to check the size criteria on a con-solidated basis. In general, parent companies should include the financial data of controlled subsidiaries and other group companies in their consolidated financial statements. However, there are cases in which, the consolidation of the company can be omitted although these cases may not conform to the general rules.

There are three exceptions to the general rule, “which suggests that the head of (part of) a group should generally prepare consolidated annual accounts as well as stand-alone accounts”:

- The holding company or the intermediate holding company qualifies as a small company in accordance with the size criteria mentioned above;

- Application of the intermediate holding company regime (article 408 Book 2 of the Dutch Civil Code).

- Application of the group regime (article 403 Book 2 of the Dutch Civil Code Book).

In accordance with article 407 Book 2 Dutch Civil Code, under certain circumstances, one or more of the aforementioned companies can be excluded from the consolidated annual accounts:

- Group companies whose total significance is immaterial to the group as a whole;

- Group companies whose financial data can only be obtained at disproportional cost or with great delay;

- Group companies which are only held for disposal.

For more information and/or professional advice about statutory audit, please do not hesitate to contact us.

No Comments